No Pane, No Gain: Exploring how “broken-window budgeting” pulls back the curtain on serious government spending.

Date Published

In the 1980s, James Q. Wilson and George L. Kelling developed a new idea surrounding crime in urban settings. The “broken-window theory,” as they called it, tied disorderliness and incivility to criminal activity. Wilson and Kelling argued that if a building’s window is broken and never repaired, the rest of the windows will follow. The window is left untended because no one cares to fix it. And if no one cares, then what’s the harm in breaking all the windows?

This principle was used to defend the usage of foot patrol officers in a crime-ridden New Jersey. During the mid-1970s, state officials thought it’d be beneficial to have officers walking the streets rather than only patrolling by car. While the initiative received criticism early on, the police presence helped cut down on disorderly behavior. With boots on the ground, they were able to establish informal control and order from within the communities. The New Jersey police aimed to stop crime before it started by nipping malicious and suspicious behavior in the bud with assistance from city locals. They repaired the broken windows before the entire building was demolished.

While broken-window theory worked well for promoting order in urban New Jersey, how does it translate to U.S. government spending? Before we introduce our concept of “broken-window budgeting” as it pertains to Capitol Hill, let’s zero in on a more local government: Oak Brook, IL.

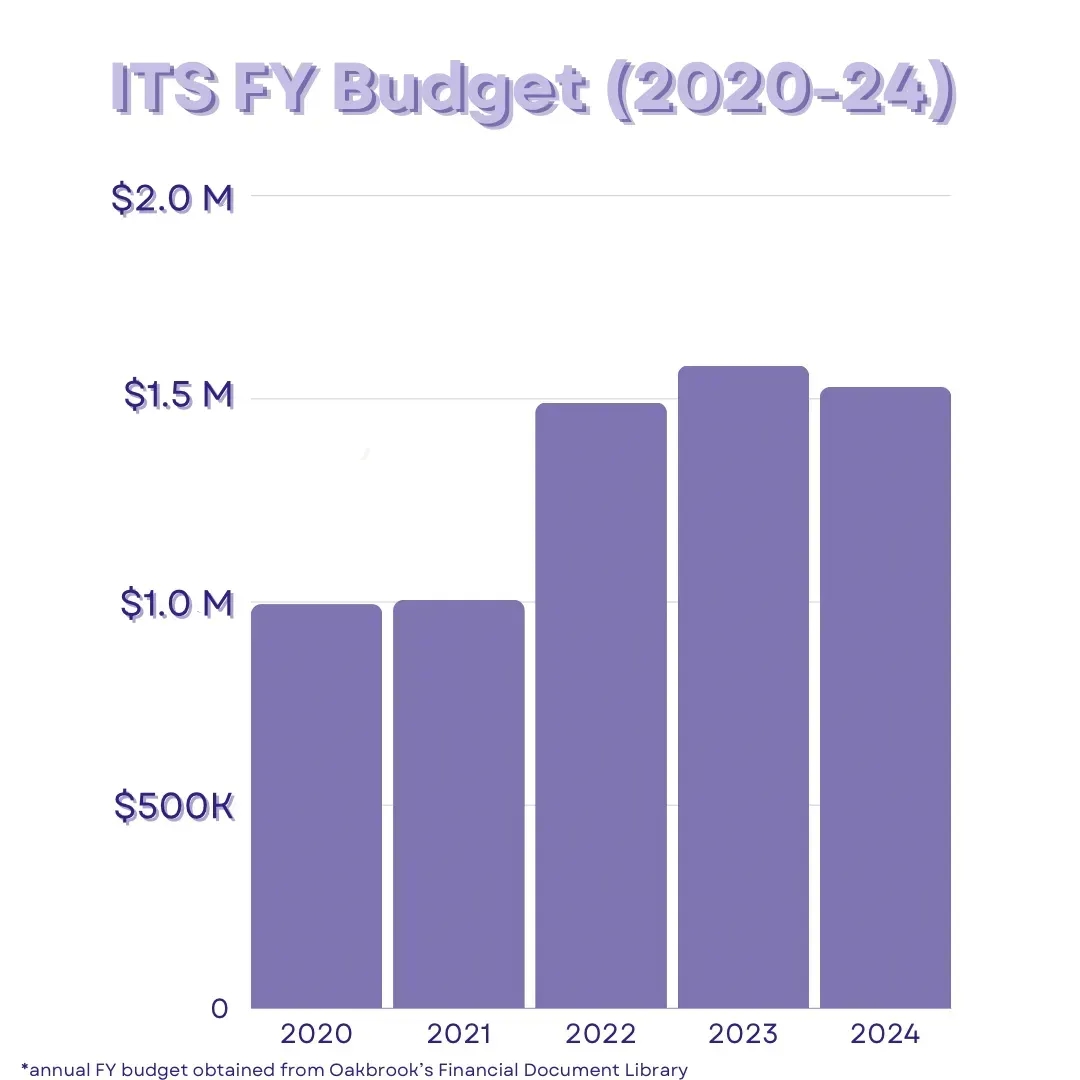

Oak Brook’s annual fiscal year budget is allocated to a variety of departments (i.e. Legal, Risk Management, Human Resources), however, it was Information Technology Services (ITS) that flagged an issue. For this case, let’s examine Oak Brook’s ITS budget from 2020-2024. As detailed in the graphic below, Oak Brook continues to spend more on information technology each year. Except in 2024, which is the first time we see a decrease in the budget. What’s the reason for the sudden spike in savings? Let’s talk about it.

The Village of Oak Brook’s Information Technology Services budget from fiscal years 2020-2024

On August 13, 2024, the Oak Brook Board of Trustees held a meeting to discuss the steady climb in the ITS budget.

The culprit? GIS services.

Geographic Information System (GIS) services analyze and display geographically referenced data linked to a specific location. GIS is especially helpful for neighborhoods and cities when urban planning or examining environmental patterns over time. So, naturally, GIS would be a valuable asset for the Village of Oak Brook.

In January of 2024, the village’s current vendor, MGP, increased fees by 3% from the previous year to $133,000. Concerned with the constant rise in cost, the board began to investigate the cause. Trustee Edward Tiesenga identified that much of the data used in these GIS systems was open-source data. Meaning, that a lot of the data was publicly available on government databases for no cost. So why would prices be increasing at such a rapid rate for reconfigured open-source data? Tiesenga’s findings encouraged Oak Brook’s technology staff to send out an RFP to 12 engineering firms. After weighing the options, Information Technology Director Tom Gilbert recommended that Oak Brook award its 2025 GIS services agreement to Gewalt Hamilton Associates for $93,000. The switch saves the village a total of $47,648 annually. Over the course of 10 years, cutting GIS costs will have saved Oak Brook nearly half a million dollars.

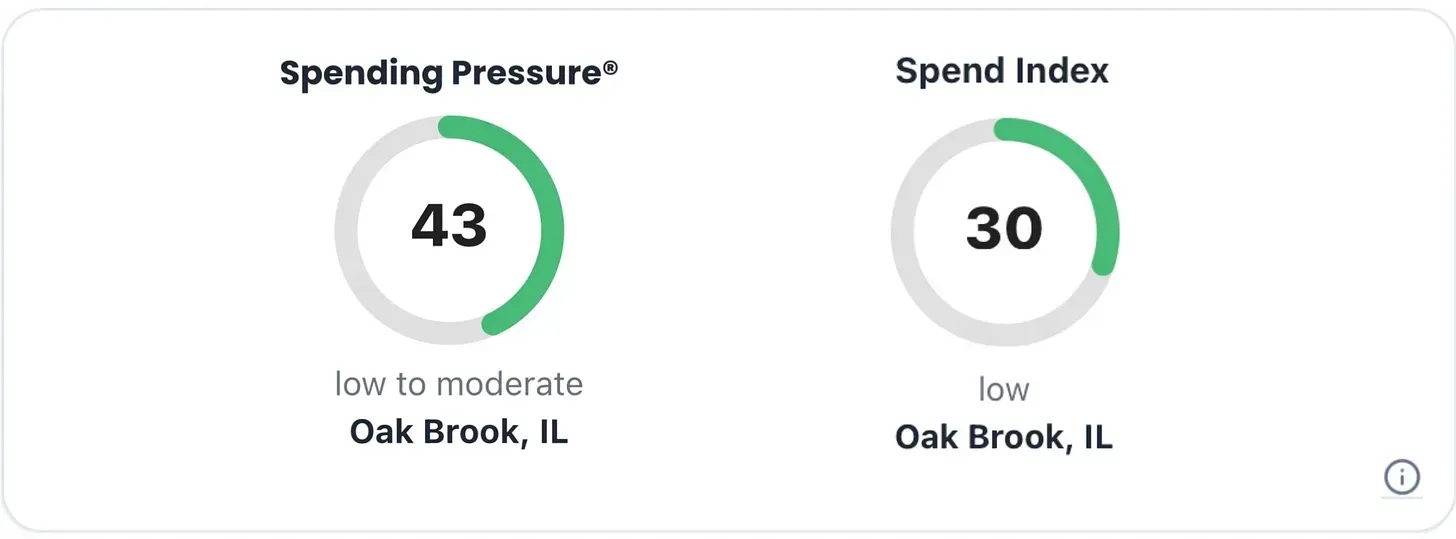

This is the idea of “broken-window budgeting” that we’re trying to highlight here. GIS services were something that flew under the radar, steadily growing and inflating costs. Each annual percent increase became another crack in the windowpane. By taking the initiative to lower technology costs, Oak Brook was able to repair the broken window— improving the budget quality while ensuring the village keeps their spending index and Spending Pressure® down.(1)

The Spending Pressure® and Spend Index of Oak Brook, IL rest at low levels.

Now, let’s paint this picture on a larger canvas: the U.S. federal budget. For decades, groups of government officials and citizens alike have been pushing for a cut in defense spending. A whopping 47% of the U.S. discretionary spending budget is allocated towards military expenditures. With a projected $850 billion defense budget for 2025, all eyes are on the DoD for potential cuts. However, as the DoD garners more and more attention, it becomes easier for smaller (and more obsolete) government programs to discreetly soak up federal funds. The government spends millions of dollars on outdated, ineffective programs, causing more and more broken windows on Capitol Hill. And with all this broken glass, Spending Pressure® continues to creep up. Spending Pressure® increases when the value of government services does not make up for taxpayer dollars. Allocating money towards inefficient government programs allows Spending Pressure® to build within the federal government, which over time will have a detrimental effect on the economy.

Although defense spending remains incredibly high, it would be much more efficient to start tackling the molehills before the mountain. Here are a couple examples of government boondoggles that, if cut or reduced, could save the U.S. millions (if not billions) of dollars:

Sheep Production and Marketing Grant Program

The USDA’s Sheep Production and Marketing Grant Program aims to “develop solutions for practical problems on a national basis and address the needs of the entire sheep industry.” However, with the sheep industry facing a massive decline in relevance, the money poured into this government program could be allocated to a much better cause. The program receives $300,000 per year to fund its operations. The U.S. Sheep Experiment Station (USSES), headquartered in Dubois, Idaho, is another program to stimulate the production of sheep. USSES has recently requested $5.1 million to fund its wildlife research efforts for fiscal year (FY) 2025. However, these initiatives have not made a significant contribution to the American people as a whole. Projects like these have succeeded in pulling the wool over taxpayers’ eyes for too long, and eliminating them is a step towards improved budget quality.

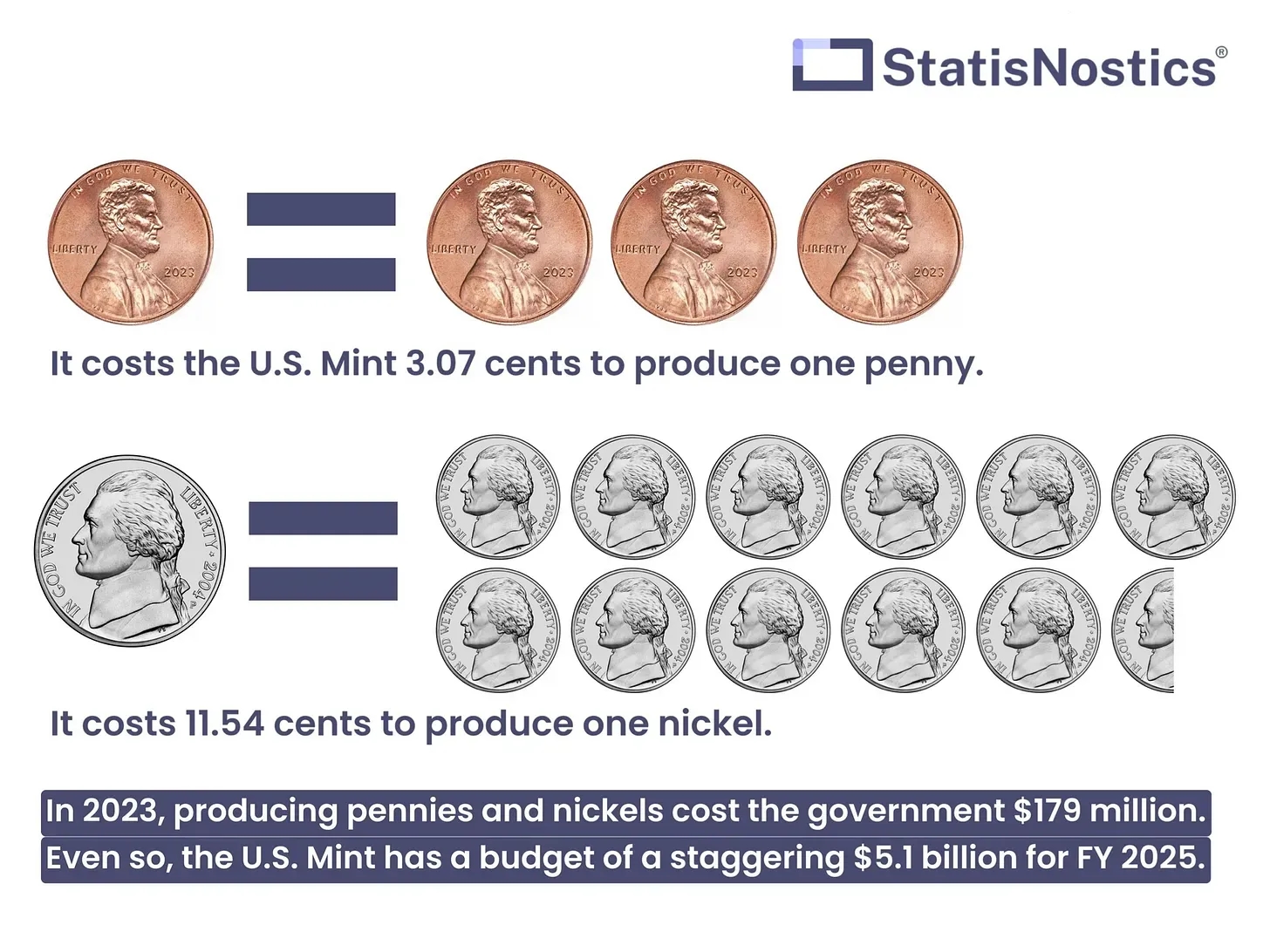

Penny Production

There’s been much controversy about the necessity of the penny. Since the 1980s, several bills have hit the Congress floor advocating for the cessation of penny production— these efforts have not yet been successful. In recent years, the U.S. Mint has confirmed that it costs approximately 3 cents to produce a singular penny. This is due to a constant increase in the cost of the metals used to create the coin (copper and zinc). The U.S. Mint had a net loss of $171 million due to penny production in 2022. So who’s rallying to keep making pennies? The main supporters are zinc miners. The U.S. Mint is the largest buyer of zinc, and miners of the metal are worried about losing employment and revenue if the nation stops the production of pennies. However, many continue to wonder about the usefulness of the penny as digital currency gains popularity. The bottom line, cutting penny production would save the country hundreds of millions of dollars every year.

Amtrak

Amtrak has proven to be a massive drain on the federal budget. In FY 2021, Amtrak lost $2 billion due to poor quality and ineffective operations. The company also runs many routes that are not profitable. Only ¾ of Amtrak’s lines arrive/depart on time. Two of the worst-performing lines, Capitol Limited and Sunset Limited, only stay on schedule 28% of the time. Even still, the U.S. government allocated $2.4 billion to Amtrak in FY 2024. While it’s unlikely that Amtrak will be completely wiped out, the privatization of the company would be highly beneficial. Amtrak would be able to shut down non-profitable routes, improve quality and performance, and evade suffocating union rules. Plus, taxpayers won’t be forced to pay for subpar transportation. Of course, this is easier said than done. But cutting Amtrak’s subsidies by even a fraction puts the U.S. government on the right track to fixing yet another window.

William F. Halsey, an American Navy admiral during World War II, asserted that, “All problems become smaller when you confront them instead of dodging them.” This is the heart of broken-windows budgeting: facing fiscal challenges head-on. For the federal government, that means to stop ignoring the deficit and start taking small steps to shave down unnecessary spending— to keep repairing the cracks in the glass.

1. George L. Kelling, James Q. Wilson. “Broken Windows.” The Atlantic, Atlantic Media Company, 20 July 2020, www.theatlantic.com/magazine/archive/1982/03/broken-windows/304465/

2. U.S. Sheep Experiment Station (USSES), www.sheepusa.org/wp-content/uploads/2024/03/ASI-USSES-2024-final.pdf. Accessed 13 Dec. 2024.

3. “Sheep Production and Marketing Grant Program.” Sheep Production and Marketing Grant Program | Agricultural Marketing Service, www.ams.usda.gov/services/grants/spmgp. Accessed 13 Dec. 2024.

4. “USDA Announces $300,000 in Funding Available to Support U.S. Sheep Industry.” USDA Announces $300,000 in Funding Available to Support U.S. Sheep Industry | Agricultural Marketing Service, www.ams.usda.gov/press-release/usda-announces-300000-funding-available-support-us-sheep-industry. Accessed 13 Dec. 2024.

5. Edwards, Chris. “Amtrak.” Downsizinggovernment.Org, www.downsizinggovernment.org/amtrak. Accessed 13 Dec. 2024.

6. “Federal Grants to Amtrak.” Federal Grants to Amtrak | FRA, railroads.dot.gov/grants-loans/directed-grant-programs/federal-grants-amtrak. Accessed 13 Dec. 2024.

7. “Buy Gold & Silver Bullion Online: Free Shipping.” JM Bullion, 8 Nov. 2024, www.jmbullion.com/investing-guide/numismatics/cost-of-producing-a-penny/#:~:text=It%20Costs%203.07%20Cents%20to%20Make%20A%20Penny%20in%202024%20%7C%20JM%20Bullion.

8. “Overview Data.” StatisNostics, statisnostics.com/overview/?address1=OAK%2BBROOK%2C%2BIL. Accessed 13 Dec. 2024.

Cover Photo Credit: lavarmsg on Vecteezy

1. Spending Pressure® is a term coined by StatisNostics that describes the relationship between the value of government services and the amount of money taxpayers are paying. StatisNostics is a database that utilizes government census data to provide statistical information on any city/town in the United States, providing a holistic view of demographic trends, housing data, economic factors and more.