How many times will you buy your house? StatisNostics does the Math.

Date Published

John Maynard Keynes famously taught and aimed to show with math equations that there is a “multiplier effect” when the government takes your money and spends it. Keynes believed that as the government increases spending, the net gain will be greater than the money spent resulting in a bigger and better economy.

In reality, the spending inspired by visions of the Keynesian multiplier just multiplies the cost of your very own house! The Keynesian multiplier implies a potential large gain from government spending. However, the government does not create any additional value, it simply reallocates it from one source to another. For instance, when you’re taxed on your house, that money is no longer yours; it is reallocated to the government to spend as they see fit. When the products of government spending don’t compensate for what you paid in property and real estate tax, the value of your home decreases while the price you pay for it increases. Which raises the question: How many times will you buy your home paying real estate taxes?

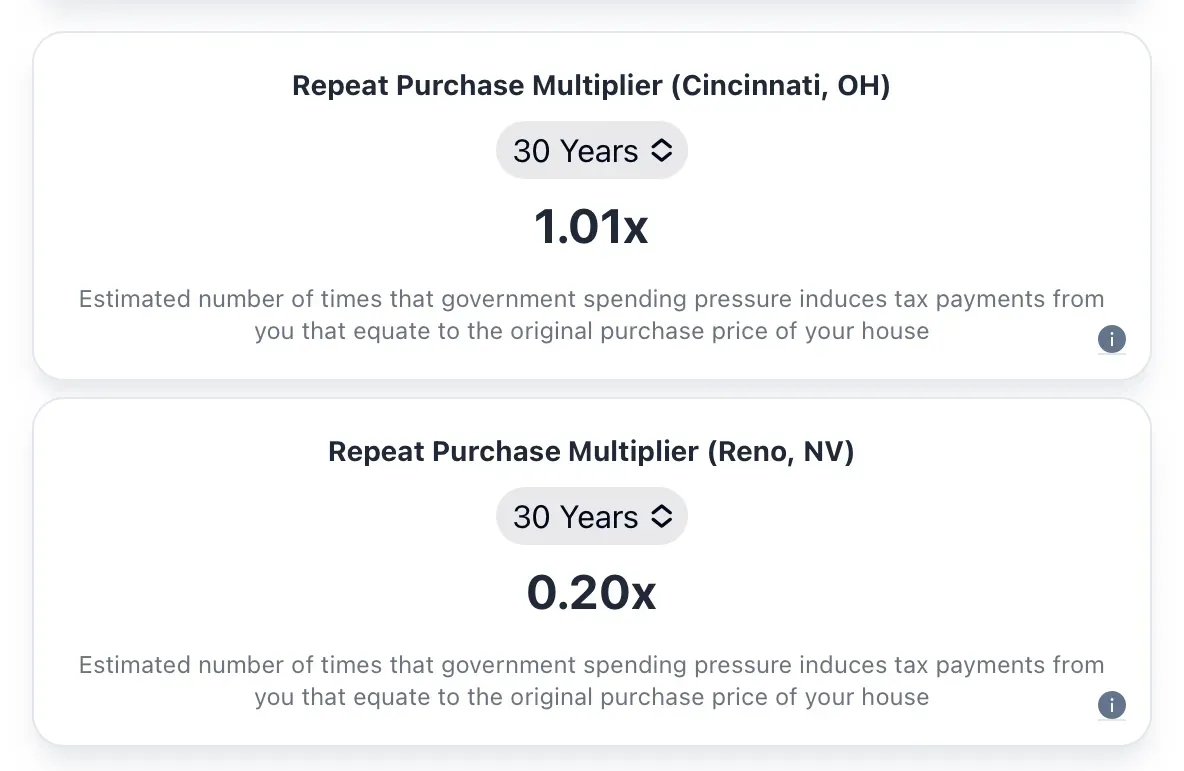

StatisNostics, a database that utilizes U.S. government census data, has an answer. With its Repeat Purchase Multiplier, or “RPM”, you can check your RPM over time, by selecting the calculation for 5 years, 10 years, or up to 30 years. The RPM is higher the longer you stay, and over time, you can see how many times you will buy your house again in the form of the real estate taxes you will pay. Different locations have higher or lower levels of tax assessments relative to the value of your house, so you can compare RPMs based on different locations. In some areas, let’s take Reno, NV, for example, residents will only pay 20% of the original price of their home in real estate tax over thirty years. In other places like Cincinnati, OH, people will pay 101% of their original home price in real estate taxes. That means over the course of thirty years, Cincinnati residents will essentially re-buy their house in the amount they pay in property and real estate tax!

A person’s earnings often act as a chance to build intergenerational wealth, particularly when invested in real estate. However, this investment is impaired when the burden of government spending appears in the form of taxes that exert downward pressure on that asset value so that people just end up in a loop of buying the same house over and over. The Repeat Purchase Multiplier shows how government taxation can turn what is typically an individual's biggest asset into a liability.

Want to know the RPM for your city? Visit www.statisnostics.com. By entering your address in the search bar and clicking the real estate tab, you can use the Repeat Purchase Multiplier to calculate how many times you will re-purchase your home over 5, 15, or up to 30 years. StatisNostics will also provide you with information on your city’s government spending data, economics, public safety, demographics, health, schools, and climate.